Take a Close Look at Your Stress Test Assumptions: Implied Volatility is Up in Most Asset Classes (VIX, MOVE, FX)

With supply chain pressures, inflation, a possible recession, and a war, it is not surprising that options prices and implied volatility are up. It's like déjà vu all over again. As senior practitioners at Capital Market Risk Advisors (CMRA) with more than 30 years’ experience each, we’ve seen this movie before. Those who don’t learn from history are forced to repeat it.

“Once in a Lifetime” Events Happen Every Few Years

Risk managers should react appropriately. It’s ok to be surprised when an unlikely event happens, when markets move or when relationships change. But, as experienced risk managers, we believe strongly that it is NOT ok to be surprised by the impact of a market or relationship move. That’s what proper stress testing should inform you about. At CMRA, we have seen all too many problems that happened when clients had not adequately stress tested their sensitivity to assumptions.

What is notable this time is that forward volatility is up for many months into the future. Typically, higher implied volatility leads to backwardation, where longer dated-volatility is lower than short-dated. But today, equity market implied volatility is high, and the volatility curve is flat all the way out to 2023. The market expects volatility to stay high for longer than is typical.

Equity market implied volatility in the near term is running in the 28-30% range. We are used to 12-17% in most of the 2010-19 period. With the S&P hovering around 4000, that implies that in a year, a one-standard deviation move leaves the S&P between about 2800 and 5200.

Bond market volatility is up by a comparable amount to equity market volatility. After many years of low absolute levels of volatility associated with low yields, bond market volatility has now risen along with equities and at times even risen faster. The MOVE index is an index of short-dated implied volatility across the Treasury yield curve.

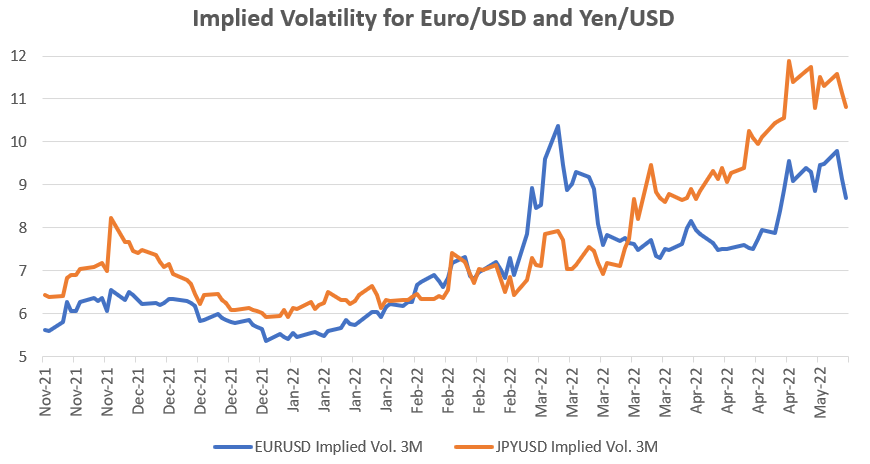

The same is true in Forex with EUR/USD and JPY/USD volatility all rising by 50-75%.

And, while Variation Margins on commodities are hitting their highs of 2020, bitcoin volatility is also high.

Conclusion

Especially in times of high volatility, it is critical to stress test your sensitivity not only to market levels but to assumptions about correlations, term structure, the volatility surface, and to other markets such as Forex and commodities. At CMRA, we have seen all too many problems that have happened when clients did not adequately stress test their sensitivity assumptions. Please call or email if you would like to discuss.

With thanks to Emily Liu for assistance in the preparation of this report.